Creatively packaged for your convenience

Imagine having an app that serves all areas of your busy life

Simple and friendly loaning process

No jumping hops to fill crazy paperwork. It's one simple process all for all services

No hidden fees or charges

No surprises, No unreasonable fees or hidden costs. Just what you owe and Bayes.

Why Choose Bayes?

![]() Quick Loan Approvals.

Quick Loan Approvals.

Instant disbursement for mobile loans, and within just 8 hours for asset-based financing.

![]() Flexible Loan Options.

Flexible Loan Options.

Transparent terms with zero surprise charges.

![]() No hidden Fees.

No hidden Fees.

Transparent terms with zero surprise charges.

![]() Referral Commissions

Referral Commissions

Earn cash when you refer friends and family.

![]() Secure & Licensed

Secure & Licensed

Fully licensed by the Central Bank of Kenya, your trust is our priority.

![]() Dedicated Customer Support

Dedicated Customer Support

Friendly and responsive support team available to guide you every step of the way.

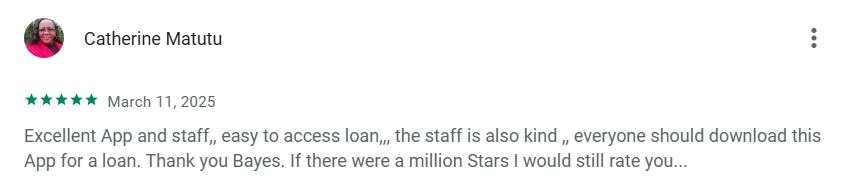

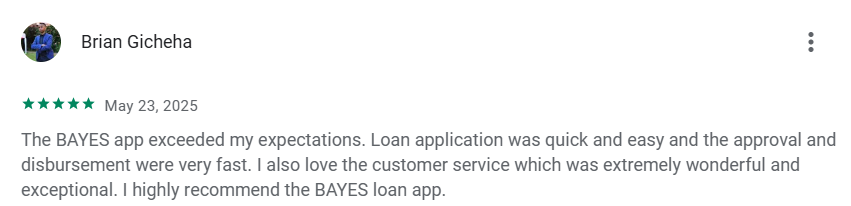

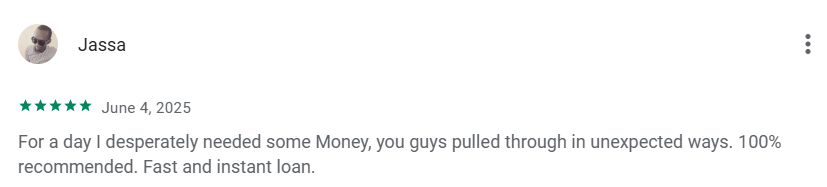

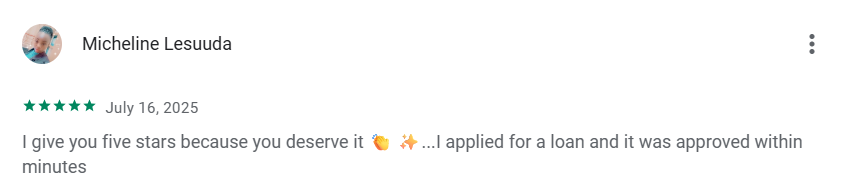

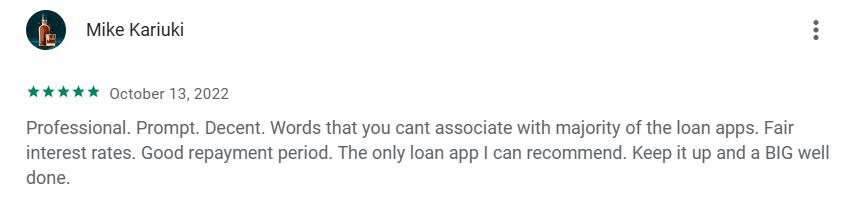

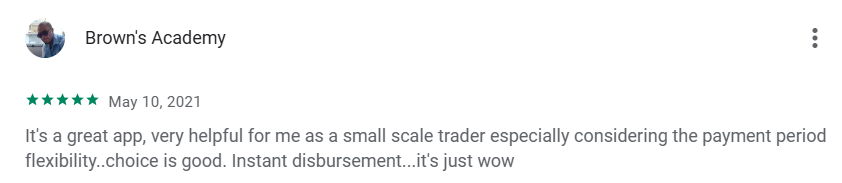

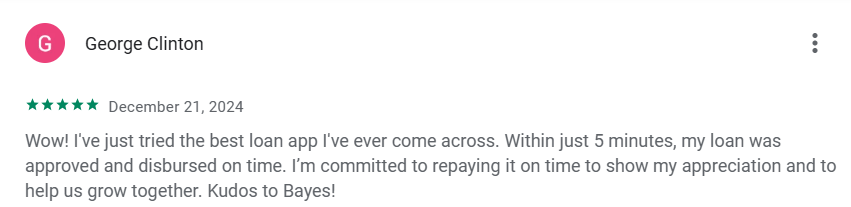

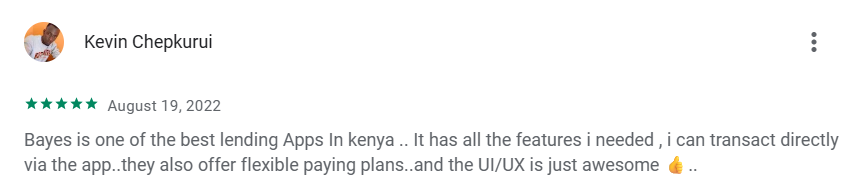

Testimonials

How to Find Us

Address

Mitsumi Business Park,

5th Floor,

Muthithi Road, Westlands

Phone

+254 759 808 086/+254759808080

Monday to Friday 8am - 5:30pm

customercare[@]bayes.co.ke